From tracking receipts to processing reimbursements, the complexities of corporate spending can quickly become a drain on resources and a large source of frustration. Expense management is a critical business process designed to streamline, control, and optimize how your organization handles its financial outgoings.

What Exactly is Expense Management?

Expense management encompasses the systems and processes a business uses to submit, process, and pay for employee-related business expenses. This can include everything from a client dinner and travel costs to software subscriptions and office supplies. Effective expense management helps ensure these expenditures are legitimate, compliant with company policy, and accurately recorded for financial reporting and tax purposes.

Historically, this process was manual, relying on paper receipts, spreadsheets, and endless rounds of approvals. However, modern expense management makes this process a lot easier.

The Power of Expense Management Software

Expense management software has transformed this once time-consuming task into a far more efficient and strategic operation. These solutions offer a suite of features designed to automate expense reports and provide spend visibility. Let’s look at some key innovations:

- Virtual Cards: Forget shared company credit cards or employees using personal funds. Virtual cards offer a secure and efficient way to control spending. These digital cards are issued for specific purposes, vendors, or spending limits, providing unparalleled control and real-time tracking of every transaction. This drastically improves spend visibility and helps enforce company expense policy at the point of purchase.

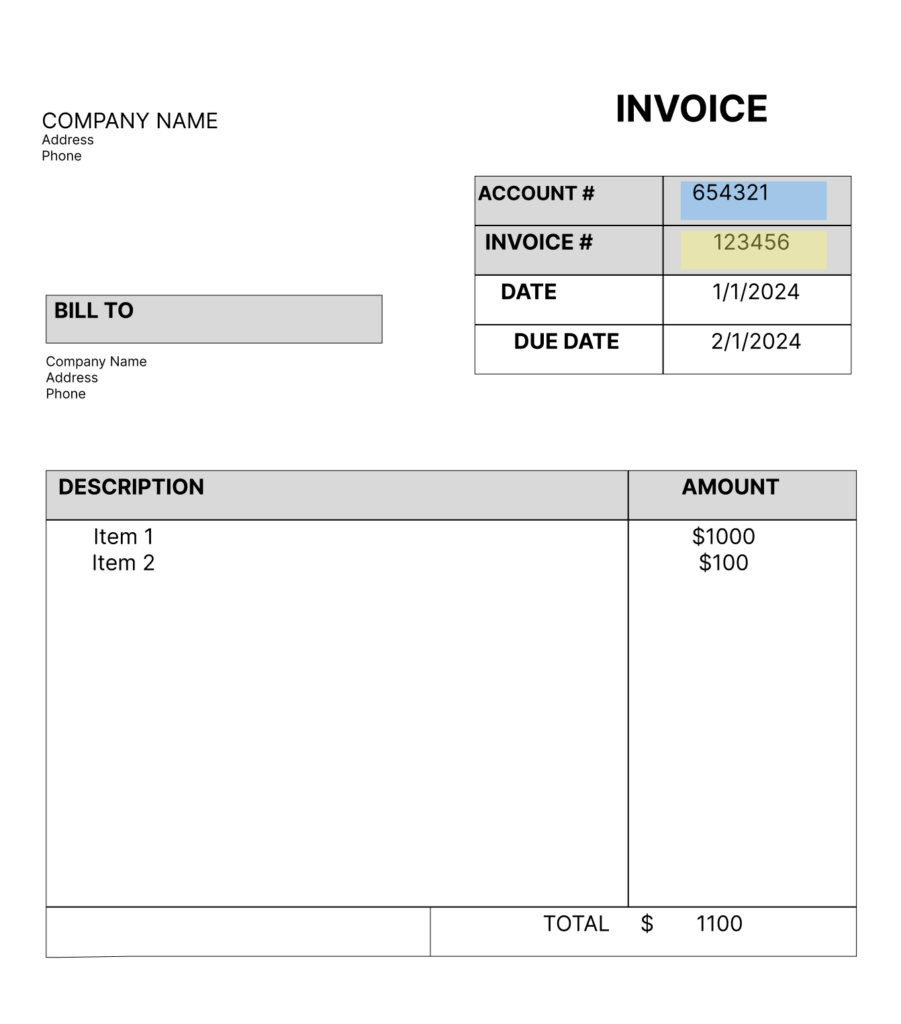

- Receipt Scanning and OCR: One of the biggest pain points in expense reporting has always been paper receipts. Modern software offers receipt scanning apps that allow employees to simply snap a photo of their receipt. Optical Character Recognition technology then automatically extracts crucial data like vendor, date, and amount, virtually eliminating manual data entry.

- Automation: Beyond just receipt processing, automation extends to the entire expense lifecycle. From automated policy checks and approval workflows to seamless integration with accounting software like QuickBooks or NetSuite, automation significantly simplifies expense reports and improves spend visibility. This means faster reimbursements for employees and less administrative burden for finance teams.

Why is Expense Management So Important?

Effective expense management is a strategic form of financial control and operational efficiency for organizations.

- Cost Control and Budgeting: By centralizing and categorizing all expenses, businesses gain a clear picture of where their money is going. This improved spend visibility is crucial for accurate budgeting and forecasting, allowing companies to identify areas for cost control and make more informed financial decisions.

- Compliance and Audit Readiness: With automated policy enforcement and detailed audit trails, businesses can ensure they remain compliant with internal policies and external regulations. This is vital for audit and compliance, preventing costly penalties and streamlining year-end financial closes.

- Fraud Prevention: Manual processes are notoriously vulnerable to errors and intentional misuse. Automated systems with real-time tracking, policy flags, and anomaly detection capabilities significantly reduce the risk of fraud detection and help safeguard company assets.

- Employee Satisfaction: No one enjoys filling out tedious expense reports. Streamlined processes, quick approvals, and faster reimbursements contribute to a happier, more productive workforce.

Common Problems

Many businesses struggle with common pitfalls in managing expenses:

- Lack of Visibility: Without a centralized system, it’s difficult to see where and how money is being spent across different departments and projects. This hinders strategic decision-making.

- Difficulty Enforcing Policies: Manual checks often lead to inconsistent application of expense policies, resulting in non-compliant spending.

- Audit and Compliance Headaches: Preparing for audits can be a time-consuming nightmare if expense records are disorganized and incomplete.

- Risk of Fraud and Errors: The absence of controls opens the door to both accidental mistakes and deliberate fraudulent activity.

The Future of Corporate Spending

Investing in a centralized expense management solution is key for businesses of all sizes, from small businesses to large enterprises. By utilizing tools like virtual cards, advanced OCR, and automation, companies can transform their expense process, allowing for more financial control, compliance, and strategic growth.