When it comes to developing and implementing new technology and systems for your financial back office, a common question arises: Should we rely on our internal IT team, or explore external alternatives? There are compelling arguments for both approaches, and understanding the pros and cons is crucial for making the right decision.

The financial back office is the operational heartbeat of your institution. It’s where critical processes like accounts payable, vendor management, reconciliation, and compliance reside. The systems supporting these functions need to be robust, secure, and highly efficient. So, let’s explore what it means to entrust these vital technological endeavors to your in-house IT department.

The Pros of Working with Your Internal IT Team

There’s a lot to be said for leveraging the talent already within your organization:

- Deep Institutional Knowledge: Your internal IT team has an intimate understanding of your company’s unique culture, existing infrastructure, historical data, and specific operational nuances. This deep knowledge can be invaluable in designing systems that truly fit your organization’s needs.

- Faster Communication and Collaboration: Being in the same building or ecosystem fosters quicker communication and seamless collaboration with other departments. This can lead to faster problem-solving and a more agile development process.

- Tailored Solutions and Customization: An internal team can build highly customized solutions that precisely address your specific requirements, without compromises. They have direct control over the development roadmap.

- Enhanced Security and Control: With an in-house team, you maintain direct control over data security protocols, intellectual property, and system access. This can provide a greater sense of security for sensitive financial data.

- Cultural Alignment: Your internal IT staff are already integrated into your company’s values and mission, potentially leading to a stronger commitment to long-term goals and a better cultural fit for the technology they create.

The Cons of Working with Your Internal IT Team

While the benefits are significant, there are also notable challenges:

- High Costs: Building and maintaining an in-house development team is expensive. Beyond salaries and benefits, you’ll incur costs for recruitment, ongoing training, software licenses, hardware, and office space. These fixed costs can be substantial, regardless of project volume.

- Limited Specialized Expertise: Your internal IT team might be proficient in maintaining existing systems, but potentially lacking deep, specialized expertise in cutting-edge financial back office technologies like advanced automation, AI-driven data capture, or complex vendor portal development. Niche skills might require costly external training or new hires.

- Time-Consuming and Resource-Intensive: Developing complex financial systems from scratch requires significant time and resources. The internal team may already be stretched thin, leading to project delays or a strain on existing operations.

- Scalability Challenges: If your business experiences rapid growth or seasonal fluctuations, scaling an internal IT team up or down can be slow and expensive. Hiring and onboarding new talent takes time, and you might face periods of overstaffing or understaffing.

- Risk of Knowledge Silos and Dependency: If only a few internal team members possess critical knowledge about a system, their departure can create significant operational vulnerabilities and knowledge gaps.

- Focus Diversion from Core Business: Your internal IT team’s primary focus should ideally be on supporting your core business operations. Diverting significant resources to large-scale system development can pull them away from other critical functions.

Exploring Alternatives

For many institutions, a blend of deep institutional knowledge and specialized external expertise can be the most effective path.

If your internal IT team is stretched thin, lacks specific expertise in areas like advanced automation or intelligent document processing, or if you’re looking for a faster time-to-market with proven solutions, exploring external alternatives is a smart move.

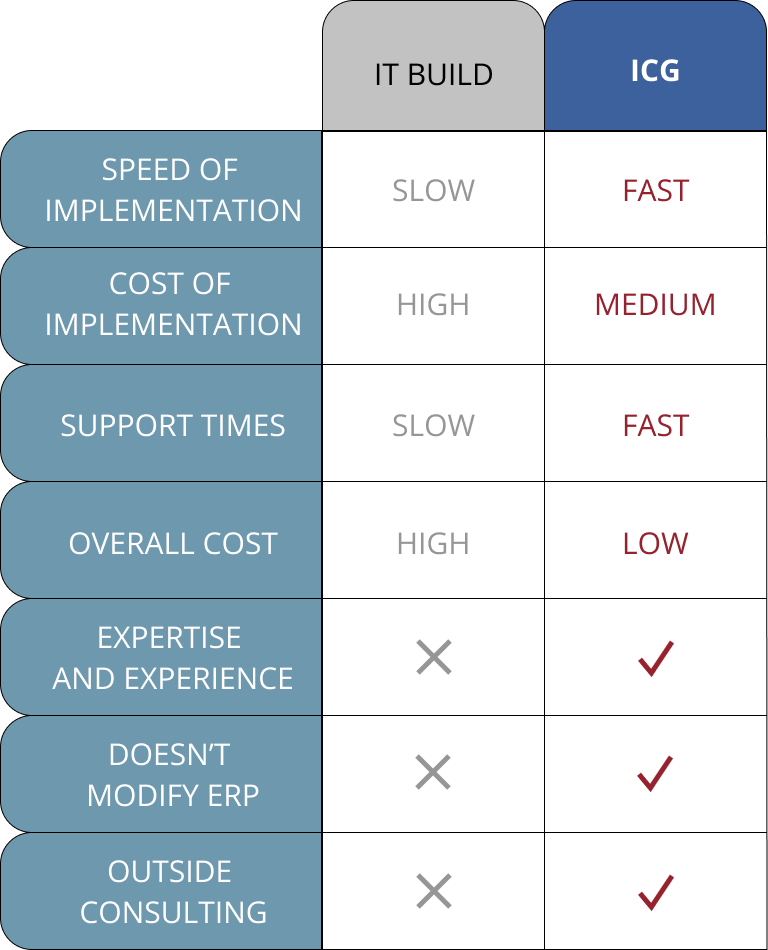

This is where companies like ICG Innovations come in. We offer a compelling alternative by providing specialized, cloud-hosted solutions for financial back-office processes. Our solutions integrate seamlessly with your existing ERP, offering a configurable, modular, and secure approach that leverages decades of experience.

Choosing the right approach for your financial back office technology is a strategic decision. By carefully weighing the pros and cons of internal development against the benefits of specialized external partners, you can ensure your operations are powered by the most efficient, secure, and future-ready systems available. To learn more, request a free demo from ICG.