Vendor portals, especially tailored ones, are powerful business tools that can address numerous pain points in your current accounts payable operations. Vendor portals can provide a platform for vendor self-service that can have immediate financial and human resource impacts on your organization. Not all vendor portals offer the flexibility and configurability to help you address the areas of concern and inefficiency your organization may be dealing with, though. When selecting a vendor portal, ensure that the solution can address areas of pain where you need relief.

Benefits of Tailored Vendor Portals

Vendor Portals are extremely helpful for both the buying company and the vendors themselves. Vendors participate in self-service, allowing both sides to save time and money. However, not all vendor portals are created the same. Your business processes and specifics may not be reflected in off-the-shelf products. Vendor Portals with tailoring possibilities make it easier to interact with your vendors. You also only have to pay for the functionality that your organization uses.

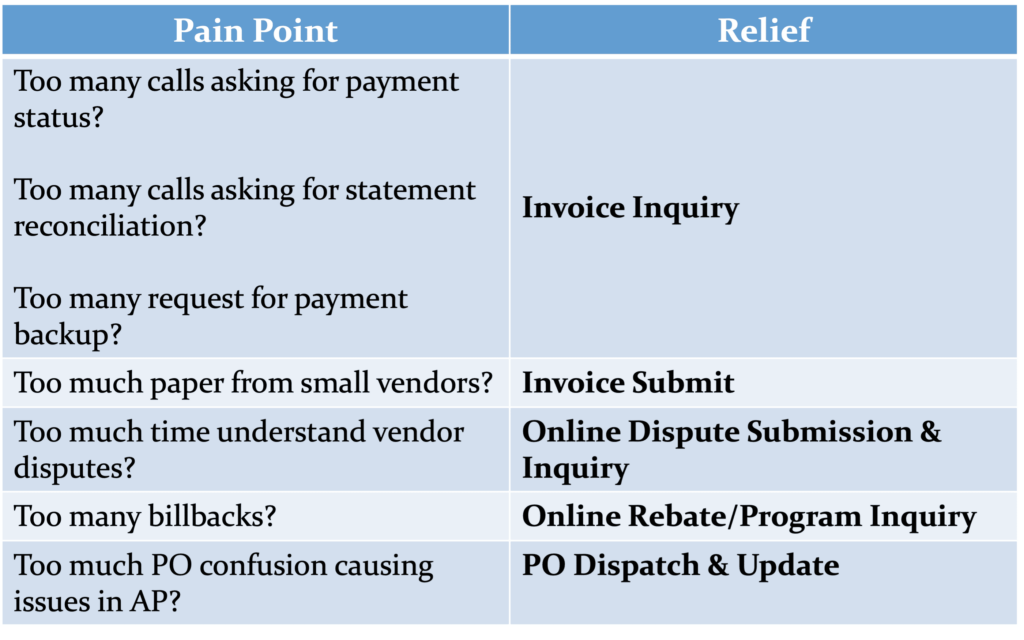

The chart below illustrates this point by listing common areas of pain in AP operations and the corresponding relief provided by vendor portal functionality:

What are your Vendor Pain Points?

With the different functions of a vendor portal in mind, make an informed decision based on your organization’s needs and decide which functionalities will deliver the biggest bang for the buck. Here are some other things to keep in mind during your technology search:

- Select functionality that drives the maximum value to your organization

- Don’t solve ALL the problems, just solve the first one, then move on to the next

- Progress over perfection

- Add functionality to your portal based on YOUR organization’s needs

Vendor portals can deliver tremendous value to your company by promoting self-service, assisting in AP automation initiatives, providing a communication vehicle between you and your vendors 24/7, reducing the burden of non-value-added activities for your AP staff, and supporting remote workforce situations for your vendors and your company.

For more information on how tailored vendor portals can add value to your AP operations, contact ICG. Or, schedule a discussion and/or demonstration of vendor portal solutions.