Vendor onboarding is a critical process for financial institutions, but it can also be a complex and time-consuming task. With the increasing number of vendors and regulatory requirements, it’s essential to streamline the onboarding process to minimize risks and improve efficiency.

Common Challenges

- Manual Processes and Paperwork: Relying on manual processes and paper-based systems can lead to delays, errors, and difficulty in complying with regulations. Completing manual vendor onboarding is also incredibly time-consuming.

- Data Security and Compliance: Protecting sensitive data and ensuring compliance with regulations is a top priority for financial institutions. Maintaining security and protecting information against data breaches is something organizations must always have under control, even though the business landscape changes daily.

- Integration Challenges: Integrating new vendors into existing financial systems can be complex, especially when dealing with multiple systems and data mapping issues. Technical issues can also be common during integration.

- Vendor Risk Management: Conducting thorough due diligence and assessing potential risks associated with vendor relationships is crucial to mitigate risks and protect the institution. Your organization is also responsible to continue to monitor vendors to ensure they remain compliant.

- Lack of Standardization: Inconsistent processes and data quality issues can hinder efficiency and scalability. This can also cause lost time and data quality issues over time.

- Vendor Communication and Collaboration: Effective communication and collaboration with vendors are essential for a smooth onboarding process, especially when dealing with time zone differences and language barriers.

Strategies for Overcoming Vendor Onboarding Challenges

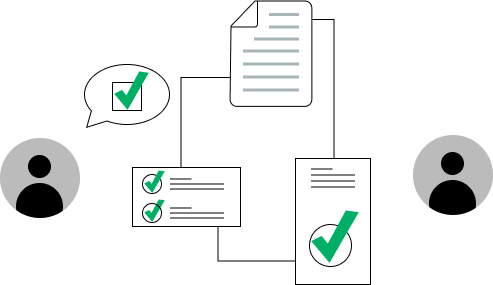

- Automate the Process: Implement automation tools to streamline manual tasks, reduce errors, and improve efficiency. There are many parts of your back office that can be automated, and starting with just one is a low-risk way to start saving time and money.

- Enhance Data Security: Invest in robust data security measures to protect sensitive information and comply with regulations. Implementing a solid data security strategy allows your organization to worry less about the the constant threats that appear in the business world.

- Utilize Integration Tools: Employ integration tools to simplify the process of connecting new vendors to existing systems.

- Conduct Thorough Due Diligence: Develop a comprehensive due diligence process to assess vendor risk and ensure compliance. Make sure that this extends to current vendors so you can verify they stay compliant after onboarding.

- Standardize Processes: Establish standardized onboarding procedures to improve consistency and efficiency. This will streamline your onboarding process, and give vendors a better experience.

- Foster Effective Communication: Utilize communication tools and channels to facilitate collaboration with vendors and address any issues promptly. Have strategies in place to use if vendor communication falters.

By addressing these challenges and implementing effective strategies, financial institutions can streamline their vendor onboarding process, reduce risks, and improve overall operational efficiency.

ICG specializes in making vendor onboarding streamlined and efficient for both organizations and their vendors. This is accomplished through several different solutions such as a great vendor portal, automation, and vendor onboarding processes. To learn more about how ICG can help your organization tackle vendor onboarding challenges, contact us or schedule a free demo.