What Is Line Item Extraction?

Line item extraction is a crucial portion of the process of invoice parsing and tracking spend within organizations. In this post, we’ll discuss the importance of line item extraction, how it works, how OCR and other technologies play a role in this process, and more.

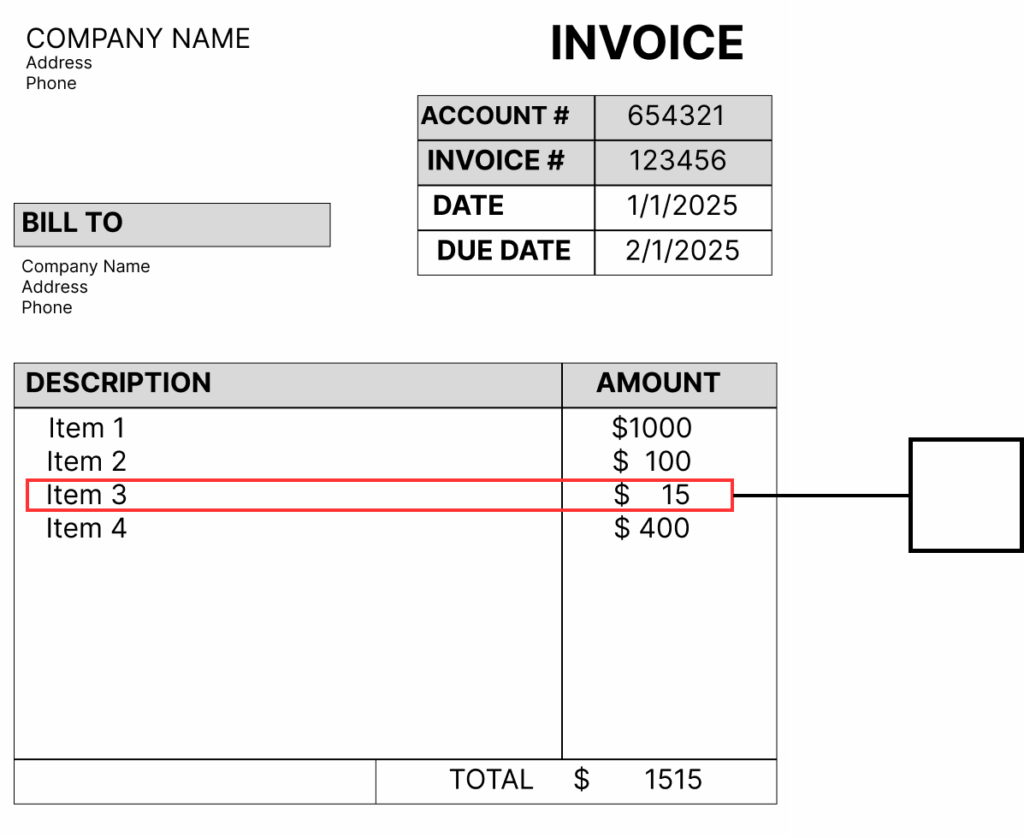

Line item extraction is the process of extracting the details of your purchase from an invoice, bill, or receipt. It is an extremely efficient way to keep track of expense categories and track your organization’s resource expenditure. The process on its own is fairly straightforward with the right technology; however, it wasn’t always as easy as it is today.

Traditionally, line item extraction was done manually by data entry professionals. Depending on the invoice, this can be an extremely time-consuming and error-prone process. In the process of trying to save money on various back-office expenses, extracting data from different line items of an invoice isn’t exactly optional for most organizations, although it is one of the more tedious tasks.

Why Is Line Item Extraction Important?

Line item extraction is useful for most organizations for tracking expenses. It allows for the categorization of different items in order to track spending for different areas. Invoices can be extremely complex and have the potential for errors created by partners.

Once this data is taken from the invoice, it is sent to an ERP or other central financial technology. This helps organizations to keep track of spending, find errors within invoices if numbers don’t add up, and add structure to invoice data for better visibility in both the short and the long term.

How Does OCR Play A Role In Line Item Extraction?

OCR assists in line item extraction by being the extractor. As OCR becomes more advanced, it is increasingly able to extract details and understand them in an almost human-like way. OCR is a great alternative to manual extraction of line item data as it can essentially accomplish the same task but faster, and in a much more reliable way, generally.

For organizations that pair OCR with AI and ML, the extraction process can go a step further, sending not only the correct information to the ERP but also contextualized information. AI and ML can greatly increase the accuracy of the data extracted from the document. Additionally, when AI/ML assists OCR, data can be extracted from all different kinds of documents, even if line items are harder to find.

Learn More

Extracting data from line items of financial documents is an essential practice made easier through technologies such as OCR. With this technology growing stronger and stronger, line item extraction is easier than ever. Adding this practice to your organization, if not already used, is essential to greater spending visibility. To learn more, contact ICG about OCR/AI/ML technology.