Decoding Your Bill

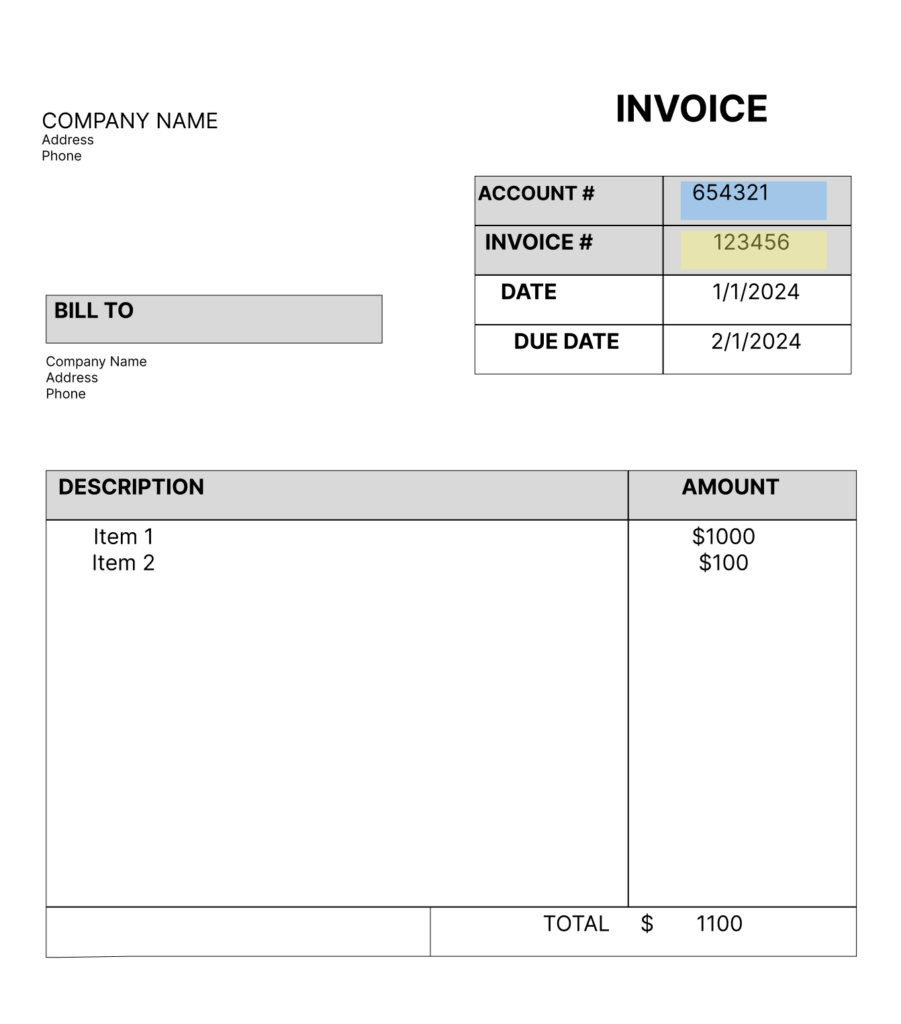

Ever opened an invoice and felt like you needed a Rosetta Stone to understand it? You’re not alone! Invoices, while essential for businesses, can sometimes look like a jumble of numbers and jargon. But understanding what each section means is crucial for accurate record-keeping, timely payments, and even tax purposes.

Let’s break down the common elements you’ll find on most invoices, shedding light on their purpose and any alternative names they might go by.

Who, What, When

These are the fundamental details that identify the parties involved and the document itself.

- Invoice Number / Bill Number / Reference Number: This is a unique identifier for the invoice itself. It helps both the sender and receiver track the specific transaction. Think of it as the serial number for your bill.

- Invoice Date / Issue Date / Date of Issue: The date the invoice was created and sent. This is crucial for calculating payment due dates.

- Due Date / Payment Due Date: The date by which the payment for the invoice is expected. This is often calculated based on the invoice date and agreed-upon payment terms (e.g., “Net 30” means payment is due 30 days from the invoice date).

- Seller Information / Issuer Details / Company Details: The full legal name, address, and contact information of the business or individual issuing the invoice. This ensures you know who you’re paying.

- Buyer Information / Customer Details / Bill-To: The full legal name, address, and contact information of the person or business receiving the invoice. This confirms who the bill is for.

- Ship-To Address (if applicable): If the invoice is for physical goods, this indicates where the items were shipped. This might be different from the “Bill-To” address if, for example, a company orders goods for a specific project site.

What You’re Paying For

This is the core of the invoice, detailing the goods or services provided.

- Line Items / Service Descriptions / Product Details: This section lists each individual good or service provided. Each line typically includes:

- Description: A clear explanation of the item or service.

- Quantity / Qty: How many units of the item were provided (e.g., 5 hours, 3 widgets).

- Unit Price / Rate: The cost per unit of the item or service.

- Line Total / Amount: The quantity multiplied by the unit price for that specific item.

- Subtotal / Net Amount: The sum of all the “Line Totals” before any taxes, discounts, or additional charges are applied. This is the total cost of the goods/services themselves.

Taxes, Discounts, and More

These elements modify the subtotal to arrive at the final amount.

- Taxes / VAT (Value Added Tax) / Sales Tax / GST (Goods and Services Tax): Any applicable government taxes added to the subtotal. The type and percentage of tax will vary depending on location and the nature of the goods/services.

- Discounts / Credit: Any reductions applied to the subtotal. This could be a promotional discount, a loyalty discount, or a credit issued for a previous return.

- Shipping & Handling / Freight Charges: Costs associated with delivering physical goods.

- Other Charges / Surcharges: Any other fees or charges that are not part of the core product/service or standard taxes (e.g., late fees, processing fees).

What You Owe

This is the number that matters most!

- Total Amount Due / Grand Total / Amount Payable: The final sum that the customer needs to pay. This includes the subtotal, taxes, shipping, and any other charges, minus any discounts.

How and When to Pay

Crucial instructions for settling the bill.

- Payment Terms / Terms and Conditions: Details about how and when payment is expected. This might include:

- “Net 30”: Payment due 30 days from the invoice date.

- “Due Upon Receipt”: Payment expected immediately.

- Late Payment Penalties: What happens if the invoice isn’t paid on time.

- Payment Instructions / Remittance Information: How to actually pay the invoice. This could include:

- Bank account details for wire transfers.

- Information for online payment portals.

- Address for mailing checks.

- Credit card payment options.

- Notes / Memo: Any additional information the sender wants to convey to the recipient. This might include a thank you message, specific instructions, or details about the project.

Why Does This Matter?

Understanding these components empowers you to:

- Verify Accuracy: Ensure you’re only paying for what you received and that calculations are correct.

- Improve Cash Flow: For businesses, knowing due dates helps manage outgoing payments.

- Simplify Bookkeeping: Accurately categorize expenses and income.

- Prevent Disputes: Clear invoices reduce misunderstandings between buyers and sellers.

So, the next time an invoice lands in your inbox or on your desk, you can decode it with confidence. It’s not just a request for money; it’s a detailed record of a transaction, and now you know exactly what each piece means!