The financial back office is slowly becoming more and more modernized as time goes on, but one area that continues to be a time-consuming and error-prone task for finance teams is General Ledger coding. However, with advanced technology, automatic GL coding is transforming how organizations categorize and manage their financial transactions.

What is Automatic GL Coding?

GL codes are unique alphanumeric identifiers assigned to financial transactions, allowing businesses to categorize them into various ledger accounts. This systematic organization is crucial for accurate financial reporting and insightful analysis.

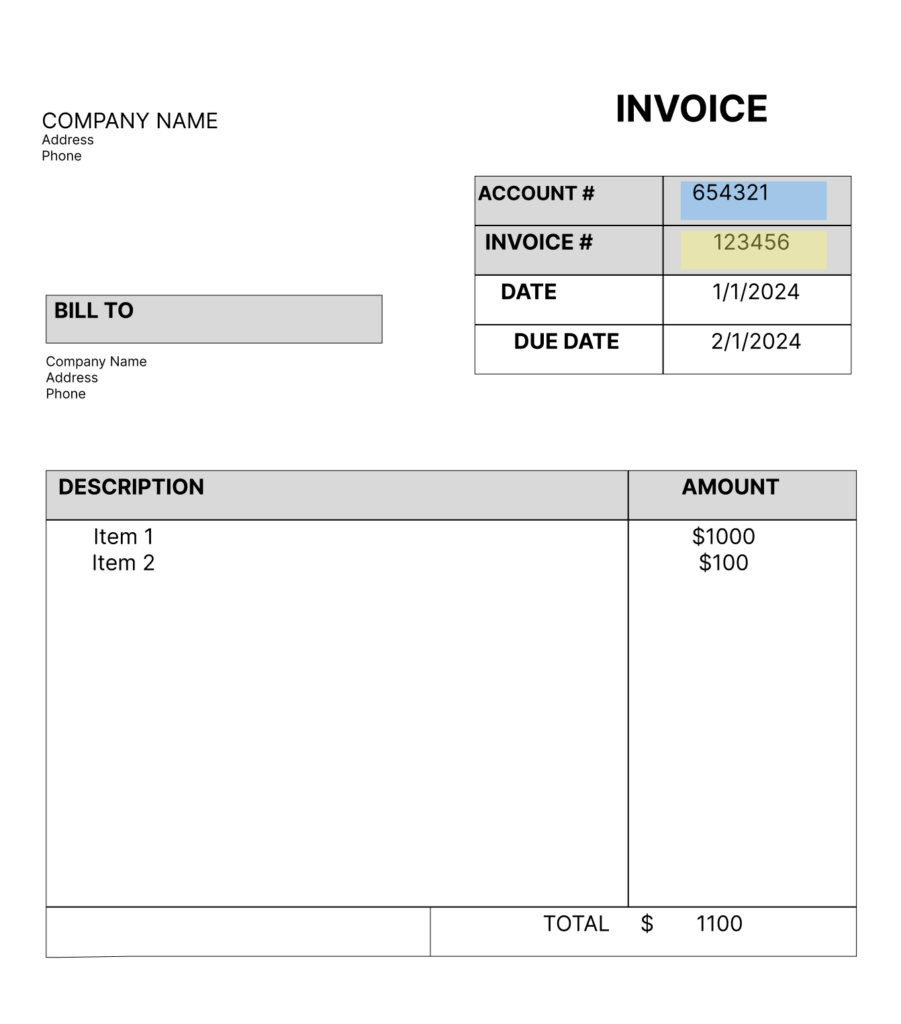

Automatic GL coding, as the name suggests, automates this process. Instead of manual data entry and classification, software uses predefined rules, historical data, and AI and ML to assign the correct GL codes to transactions, particularly for invoices and other incoming financial documents.

Pros and Cons

Like any technological advancement, automatic GL coding comes with many benefits and a few considerations.

Pros

- Increased Accuracy: Manual data entry is inherently prone to human error. Automation significantly reduces misclassifications, leading to cleaner, more reliable financial data and improved audit compliance.

- Time Efficiency & Faster Processing: Hours can be saved by eliminating manual coding for thousands of invoices. This frees up your finance team to focus on higher-value tasks like financial analysis, strategic planning, and identifying cost-saving opportunities. Invoices can be processed much faster, leading to quicker approvals and payments.

- Cost Savings: Reduced manual labor directly translates to lower operational costs. Furthermore, faster processing can help businesses capture early payment discounts and avoid late payment penalties.

- Enhanced Financial Visibility & Insights: With consistently and accurately coded data, organizations gain insights into spending patterns and overall financial health. This empowers better decision-making, budget optimization, and more accurate forecasting.

- Improved Compliance: Automated systems ensure transactions are coded consistently and follow company policies and regulatory requirements. This simplifies audits and reduces compliance risks.

- Scalability: As transaction volumes increase, automatic GL coding systems can scale effortlessly, handling the increased workload without requiring a proportional increase in manual resources.

Cons

- Initial Setup and Configuration: Implementing an automatic GL coding system requires an initial investment of time and resources for setup, configuration of rules, and integration with existing systems.

- Data Quality Dependence: The accuracy of automatic coding heavily relies on the quality of historical data used for training AI/ML models. Inaccurate or inconsistent historical data can lead to incorrect predictions.

- Exception Handling: While automation handles the majority of transactions, complex or unusual cases may still require manual review and intervention. The system needs a clear process for flagging and resolving such exceptions.

- Integration Challenges: Seamless integration with existing Enterprise Resource Planning (ERP) systems and other financial software is crucial for optimal performance. Poor integration can lead to data discrepancies.

- Requires Ongoing Maintenance: Rules and models may need periodic review and adjustment as business operations evolve or new types of transactions emerge.

How Automatic GL Coding Helps Your Organization

Beyond the general pros, automatic GL coding specifically helps organizations by:

- Streamlining AP Workflows: It significantly accelerates invoice processing, from receipt and data extraction to coding and approval. This leads to faster vendor payments and improved vendor relationships.

- Facilitating Better Budget Management: Expense categorization allows for more precise budget allocation and monitoring. This helps identify areas of overspending or opportunities for cost optimization.

- Enhancing Financial Reporting: By ensuring consistent and accurate data, it provides a solid foundation for generating reliable financial statements. This enables stakeholders to make informed decisions with confidence.

- Reducing the Burden on Accounting Staff: It frees up valuable time for finance professionals, allowing them to shift from tedious, repetitive tasks to more strategic and analytical responsibilities that add greater value to the organization.

The Technology Enabling This Transformation

The power behind automatic GL coding lies in a combination of sophisticated technologies:

- Rule-Based Automation: At its core, many systems rely on pre-defined rules. For example, an invoice from a specific vendor might always be coded a certain way, or a certain keyword in an invoice description could trigger a specific GL code.

- OCR: This technology enables the system to “read” and extract relevant data from various document formats, such as scanned invoices or digital PDFs, converting unstructured data into structured, usable information.

- AI and ML: This is where automatic GL coding truly becomes intelligent. AI and ML algorithms learn from historical GL coding patterns and past transactions. The more data they process, the smarter and more accurate they become.

- Predictive Coding: ML models can predict GL codes based on vendor, invoice content (line items, descriptions), and even the nature of the transaction.

- Confidence Scoring: Advanced AI systems can provide a “confidence score” for their predictions, flagging low-confidence cases for human review, ensuring accuracy while minimizing manual oversight.

- Continuous Learning: The AI constantly adapts and improves based on user corrections and new data, making the system increasingly efficient and precise over time.

- ERP Systems: Modern ERP systems are central to automatic GL coding. Many ERPs now offer built-in automation features or seamlessly integrate with specialized AP automation software. This integration ensures that coded invoice data transfers automatically to the organization’s accounting system. This maintains data consistency across the entire financial ecosystem.

Conclusion

Automatic GL coding is a powerful and accessible solution for organizations looking to modernize their financial operations. By using this technology, businesses can significantly enhance accuracy, boost efficiency, gain deeper financial insights, and more. While an initial investment and careful setup are required, the long-term benefits make automatic GL coding an invaluable asset.